ROE article on Property investing by Stuart Chng, Executive Group District Director at Huttons, is a renowned leader and personality in the real estate industry. https://www.stuartchng.com/post/roe-vs-roi-an-important-factor-that-property-investors-overlook

Saturday, December 27, 2025

Monday, November 17, 2025

Friday, November 14, 2025

Saturday, October 4, 2025

Saturday, September 27, 2025

100% stocks maximize long-term wealth, while a 60/40 stock-bond mix reduces volatility but greatly limits returns ($33,033 vs. $4,200).

From Adam Khoo post

https://www.facebook.com/share/p/1ZiixkqAo2/

100% invested in Equity (stocks) will maximise your returns/wealth accumulation over the long run.

A mix of stocks and bonds (60%/40%) will lower volatility during recessions but you sacrifice a large part of your potential gains. $4,200 versus $33,033.

There is no right or wrong way to invest. Would you rather get lower returns with lower volatility or higher returns with higher volatility?

Sunday, September 14, 2025

Top 8 ETFs to buy for Singapore Investors in 2025

Top 8 ETFs to buy for Singapore Investors in 2025 (by Financial Horse)

Sunday, August 24, 2025

ETF comparison

Irish-Domiciled : 15% dividend tax

U.S.-domiciled vs Ireland-domiciled ETF estate tax comparison:

| Criteria | U.S.-Domiciled ETF | Ireland-Domiciled ETF (UCITS) |

|---|---|---|

| Estate Tax Exposure | Yes – considered U.S.-situs property; subject to U.S. estate tax. | No – Irish-domiciled, not U.S.-situs; not subject to U.S. estate tax. |

| Exemption Threshold | Only US$60,000 exemption; above this, U.S. estate tax up to 40% applies. | Not applicable; no U.S. estate tax filing required. |

| Dividend Withholding Tax | 30% on U.S. dividends for Singapore investors (non-treaty country). | 15% effective rate via U.S.–Ireland tax treaty inside the fund. |

| Singapore Context | Singapore has no estate duty – U.S. estate tax is the main risk. | Same – but Ireland domicile avoids the U.S. estate tax risk entirely. |

| Community / Expert View | Generally discouraged by global investors due to estate tax trap and higher dividend tax. | Widely recommended for non-U.S. investors (e.g. CSPX, VWRA, VUAA) to avoid U.S. estate tax. |

Quick notes (context you may find useful):

-

Singapore currently has no estate duty, so the key exposure here is the U.S. estate tax if you hold U.S.-situs assets directly (including U.S.-domiciled ETFs). (IRS)

-

Irish-domiciled UCITS ETFs also tend to be dividend-efficient for U.S. stocks (15% treaty rate inside the fund vs 30% if you hold U.S.-domiciled ETFs directly as a Singapore tax resident), but that’s a dividend withholding point, not estate tax. (No Money Lah)

| S&P 500 ETF (e.g., SPY, VOO) | NASDAQ ETF (e.g., QQQ, QQQM) | |

|---|---|---|

| Index Tracked | S&P 500 (500 large US companies) | NASDAQ-100 (100 largest non-financial companies on NASDAQ) |

| Sector Exposure | Broad: Tech, Healthcare, Financials, Industrials, etc. | Tech-heavy: Apple, Microsoft, NVIDIA, Amazon, etc. |

| Diversification | More diversified | More concentrated (especially in tech) |

| Volatility | Lower | Higher |

| Dividend Yield | Typically higher (~1.3–1.6%) | Lower (~0.5–0.8%) |

| Growth Potential | Slower, more stable | Faster, more aggressive growth |

-

S&P 500 ETF (VOO, SPY): ~11–12%

-

NASDAQ ETF (QQQ): ~14–16%

Suggested Strategy

-

Balanced approach: Some investors split 60% S&P 500 and 40% NASDAQ to balance stability with growth.

-

Dollar-cost averaging: Invest over time to reduce timing risk.

| Index / ETF | Annualized Return (20-Year) | Notes |

|---|---|---|

| S&P 500 (e.g., VOO, SPY) | ~9.5% – 10.0% | Includes broad US market exposure |

| NASDAQ-100 (e.g., QQQ) | ~12.5% – 13.5% | Strong tech-driven performance |

| Feature | SPYL | CSPX |

|---|---|---|

| Full Name | SPDR S&P 500 UCITS ETF (Acc) | iShares Core S&P 500 UCITS ETF (Acc) |

| Ticker Symbol | SPYL | CSPX |

| Domicile | Ireland (UCITS) | Ireland (UCITS) |

| Index Tracked | S&P 500 Index | S&P 500 Index |

| Structure | Accumulating (dividends reinvested) | Accumulating (dividends reinvested) |

| Launch Date | 31 Oct 2023 (newer fund) | 19 May 2010 (long track record) |

| Assets Under Management (AUM) | ~€9.9 bn | ~€106 bn |

| Expense Ratio (TER) | 0.03% p.a. (cheapest UCITS S&P 500) | 0.07% p.a. |

| Replication Method | Physical (optimised sampling) | Physical (optimised sampling) |

| Liquidity / Trading Volume | Growing, but lower than CSPX | Very high, extremely liquid |

| Popularity | Gaining traction, attractive due to low fees | Most popular UCITS S&P 500 ETF, widely used in SG/EU |

| Best For | Cost-sensitive investors who want the cheapest fee | Investors wanting liquidity, proven history, tight spreads |

-

SPYL = lowest fee, but newer and smaller.

-

CSPX = more expensive, but highly liquid with a 15-year proven track record.

Saturday, August 9, 2025

Tuesday, August 5, 2025

Saturday, August 2, 2025

Sunday, July 27, 2025

GENIUS Framework

The GENIUS Framework

G – Grind Fast

Move fast. Launch fast. Learn

fast.

Instead of overplanning, get

something out and improve quickly.

E – Eliminate Bureaucracy

Flatten hierarchies. Kill approval

chains.

Empower engineers to make

decisions on the ground.

N – Normalize Failure

Mistakes aren’t shameful - they’re

feedback.

Celebrate what went wrong if you

learn from it faster than others.

I – Iterate Relentlessly

Don’t wait months to make changes.

Use every test, every failure,

every micro-feedback to build version 2.0 - fast.

U – Understand the Core Problem

Musk always asks: “What is the

fundamental problem we’re solving?”

Go beyond surface fixes. Break the

problem down to its physics and rebuild from first principles.

S – Speed of Innovation > Size of Company

Big teams don’t win. Fast-learning

teams do.

Tuesday, July 8, 2025

Saturday, July 5, 2025

Time for another update - AK71

https://singaporeanstocksinvestor.blogspot.com/

Sunday, June 22, 2025

Wednesday, June 18, 2025

Monday, May 26, 2025

Sunday, May 25, 2025

Tuesday, May 20, 2025

Monday, May 12, 2025

Sunday, April 20, 2025

Tuesday, April 8, 2025

Smoot-Hawley Act

The Smoot-Hawley Act, officially known as the Tariff Act of 1930, was a U.S. law that raised tariffs (taxes) on over 20,000 imported goods to historically high levels. It was signed into law on June 17, 1930, by President Herbert Hoover. The act was sponsored by Senator Reed Smoot of Utah and Representative Willis C. Hawley of Oregon, both Republicans, with the intention of protecting American farmers and industries from foreign competition during the early stages of the Great Depression.

The main effects of the Smoot-Hawley Act were:

- Increased Tariffs: It raised the average tariff on dutiable imports from about 38% to over 45%, with some rates going much higher. For example, tariffs on agricultural products like butter and wool were significantly increased.

- Global Trade Retaliation: Other countries responded by imposing their own tariffs on U.S. goods, leading to a sharp decline in international trade. Canada, a major U.S. trading partner, retaliated almost immediately, and European nations followed suit.

- Economic Impact: Historians and economists debate its role in worsening the Great Depression. While it didn’t cause the Depression (which began in 1929), it likely deepened it by choking off global trade. U.S. imports dropped by about 40% between 1930 and 1932, and exports fell similarly.

- Political Fallout: The act became a symbol of protectionism gone wrong. It was widely criticized, even at the time—over 1,000 economists signed a petition urging Hoover to veto it. It’s often cited as a lesson in how trade wars can backfire.

The Smoot-Hawley Act was eventually scaled back in the 1930s and 1940s as the U.S. shifted toward freer trade policies under the Reciprocal Trade Agreements Act of 1934. Today, it’s remembered as a cautionary tale about the dangers of excessive protectionism.

Sunday, March 30, 2025

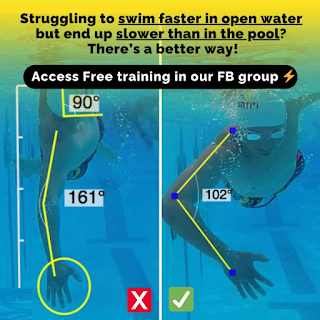

How To Stay In A Streamline Position While Breathing

Make sure to start the next stroke when your leading hand is fully extended in front

How to use your lats when you swim

Friday, March 28, 2025

Why U.S. ETFs may be costing you more than you think—and how to fix it

Great article from The Fifth Person

https://fifthperson.com/us-etfs-costing-you-how-to-fix-it/?utm_source=newsletter&utm_medium=email&utm_campaign=weekly-newsletters&utm_content=us-etfs-costing-you-how-to-fix-it&he=slimth00%40yahoo.com.sg&el=email&inf_contact_key=45eb9633473f98eb7cf8bfaefb1b4256680f8914173f9191b1c0223e68310bb1

Sunday, March 23, 2025

Friday, March 21, 2025

Only Singaporeans get it "SPDR S&P 500 ETF Trust (SGX:S27)"

- Many Singaporeans invest in the S&P 500 via SPY or VOO ETFs listed in the US, unaware of better options locally.

- Investing in US-listed ETFs exposes Singaporeans to additional costs: custodian fees, dividend withholding tax (30%), and US estate taxes.

- CSPX (UCITS) offers tax advantages but still incurs custodian fees.

- Robo-advisors like EndowUs offer access to the S&P 500 using CPF/SRS, but fees can add up.

- SGX-listed SPDR S&P 500 ETF (S27) avoids custodian fees and allows SRS and CDP investing.

WTF is an ETF? by App Economy Insights LLC

Warren Buffett said that when he dies, 90% of his wife’s inheritance will go into a single investment. He explained in his 2013 sharehold...

-

https://indexes.nasdaqomx.com/docs/fs_ndx.pdf https://www.youtube.com/watch?v=R80FtG2kX9o US-Domiciled : 30% dividend tax Irish-Domicile...

-

Top 8 ETFs to buy for Singapore Investors in 2025 (by Financial Horse)

-

Good rotation Don't rush the PULL Avoid these 3 mistakes